The coronavirus pandemic has affected us all in some way, and while there have been various support schemes put in place by the UK government, many people and businesses have been left out. Claire Baldwin takes a look at who’s struggling and what you can do to help.

At least 3 million people have been left out of financial support during the coronavirus pandemic and are facing financial difficulties that are out of their control.

This means that some businesses may go under when they would have survived if they had given the same support that others received. Companies may also choose to take more risks both financially and in terms of the safety of their staff and customers in order to make ends meet.

What problems are small businesses facing right now?

Not being self-employed

While setting up your own business seems like the definition of being self-employed, this depends on the type of business that you run and your role within it.

Directors of limited companies are not classified as being self-employed. Therefore, those who have set up their own limited company and taken on the role of Director are not eligible for the government’s self-employment income support scheme, even if they are struggling to earn money due to the pandemic.

Not being established enough

The government’s self-employment income support scheme was only made available to those who have been self employed for at least three years.

This means that newer businesses are not eligible for support, despite being more likely to need support than established companies.

Not having commercial premises

A grant has been made available as a means to support small businesses, but this grant is tied to the use of commercial premises.

For many small businesses, freelancers and sole traders, it is not economical to pay for an office space, as simply covering these overheads requires a lot of income. Additionally, many businesses with commercial premises—particularly those who have had to furlough staff or let them go altogether—have had to give up their lease to make ends meet.

Not wanting to take on debt

The coronavirus Bounce Back Loan was recently introduced with the intent to lend money to small and medium-sized businesses.

During this uncertain economic landscape, many businesses owners are extremely wary of taking out loans and potentially increasing their debt. Owners will become liable for repayments on top of any other outstanding debt caused by difficulties caused by the pandemic, and there is no guarantee that business will pick up enough for them to get by.

Not wanting to furlough

While the furlough scheme has been able to support many employees in the UK, it’s not so easy for company directors and small businesses.

The unpredictable nature of self-employed income means that a person’s average salary may work out to be fairly low, so the 80% furlough pay won’t cover their current living costs.

Workers who have been furloughed are also not allowed to carry out work for the company, meaning they can’t work towards saving the business.

Who’s helping us?

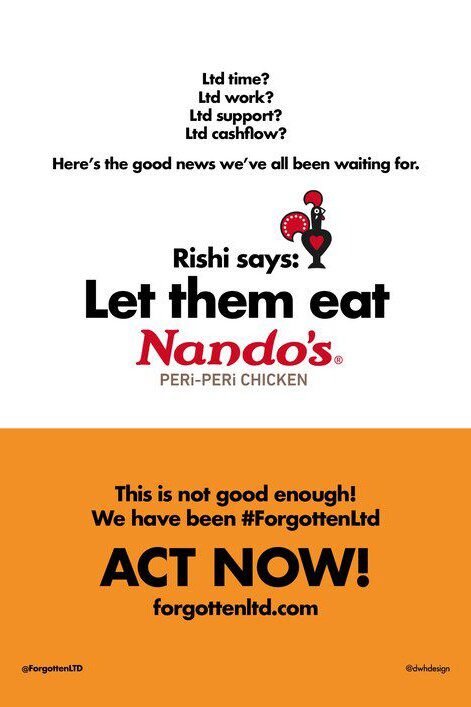

#ForgottenLtd

The #ForgottenLtd Campaign exists to raise awareness of the lack of government support for the small business community across the UK.

Many small limited companies are not eligible for meaningful support, despite many having felt the effects of reduced trading more than their larger counterparts.

The campaign is not demanding charity or handouts; its key message is one of parity, urging the government to offer fair and equal support to businesses of all sizes.

ExcludedUK

ExcludedUK is a non-profit NGO serving as a platform for those entirely or largely excluded from the government’s COVID-19 financial support.

As well as raising awareness and campaigning for more support, ExcludedUK offers a community forum, business listings, and opportunities to offer support to others.

Many of us have felt isolated during the recent months of lockdown and uncertainty, and the organisation provides an important service, allowing those affected to feel included instead of excluded.

You!

Whether or not you’ve been excluded from financial support, you can get your voice heard and help the UK’s wonderful business community to survive.

If you’d like to help out, #ForgottenLtd has a list of ways that you can take action, such as sharing content on social media, signing petitions and writing to your MP. ExcludedUK also offers many methods of support, including signing their open letter.

If you have a few moments to spare, we (and the entire UK small business community) would be extremely grateful if you could take action to support us.

Claire Baldwin

Claire has over 10 years' copywriting experience across a range of print and digital media, working with a variety of styles, formats and tones of voice. She has written as part of an in-house team client side, as well as at marketing agencies based in the East Midlands. Claire's services include copywriting, copy editing, content creation and proofreading.